Boards rarely judge strategy by ambition or articulation. They judge it by organizational response – what changes, what accelerates, and what stubbornly does not. Across industries, when a strategy is not working, five measurable patterns tend to surface well before financial performance visibly deteriorates.

Red Flag 1: Strategic Decisions Lose Velocity

What boards observe

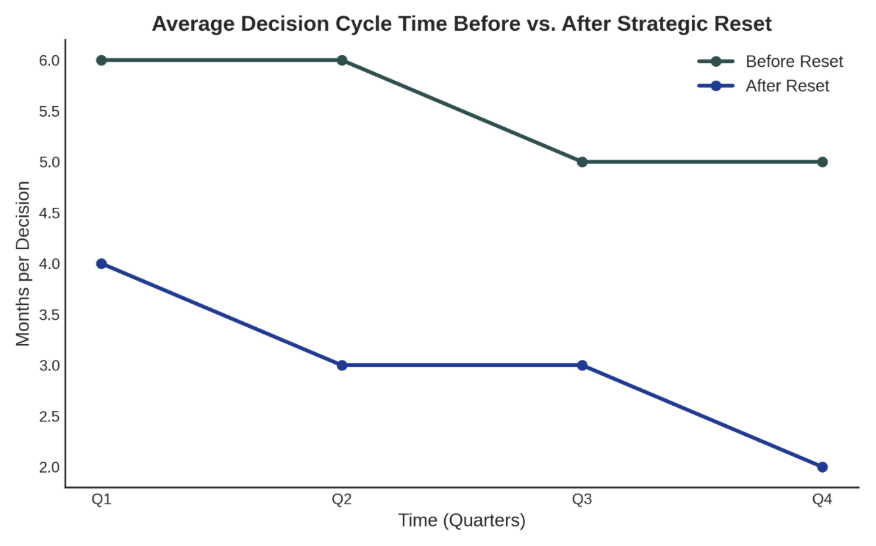

In organizations where strategy execution is faltering, decision cycle times increase by 30–50% within 12–18 months of a new strategic push. More decisions escalate upward. Fewer are resolved at the right level.

What the environment demands

In volatile markets, advantage increasingly comes from decision velocity, not decision perfection.

What “good” looks like

High-performing organizations typically:

- Resolve 70–80% of material decisions at the first accountable level

- Review and reverse decisions within weeks, not quarters

Implication for the CEO

Boards interpret declining decision velocity as a signal that the strategy lacks clear ownership or internal conviction.

Red Flag 2: Cost Inefficiencies Become Structurally Embedded

What boards observe

In underperforming strategies, costs tend to grow 1.3–1.6× faster than revenue over a three-year period.

Productivity initiatives deliver short-term savings but fail to reset the baseline.

What the environment demands

With capital discipline tightening, boards expect structural cost advantages, not episodic efficiency programs.

What “good” looks like

Strategy-led cost models typically show:

- 15 – 25% cost differentiation between core and non-core activities

- Reinvestment of 30–50% of savings into priority growth areas

Implication for the CEO

Persistent cost drift signals that strategy is not actively governing resource allocation.

Red Flag 3: Incentive Misalignment Undermines Execution

What boards observe

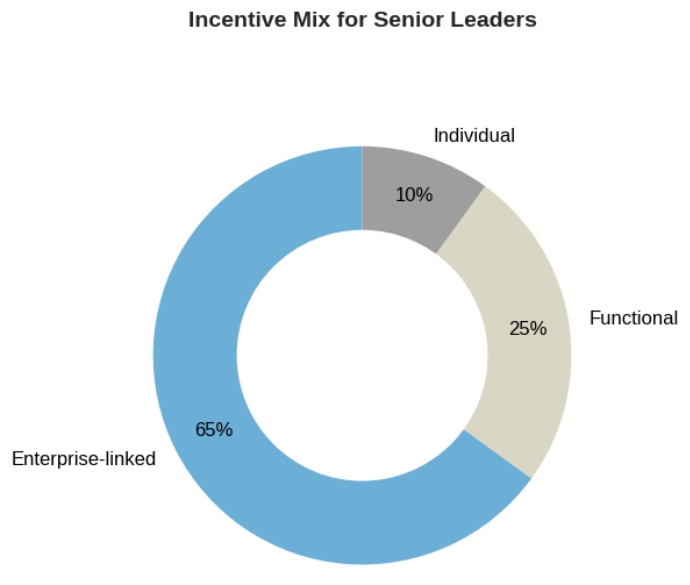

In organizations where strategy stalls, less than 40% of senior leaders’ incentives are tied to enterprise-wide outcomes. The remainder reinforce functional or local optimization.

What the environment demands

Complex strategies require coordinated leadership behavior, not isolated excellence.

What “good” looks like

In aligned systems:

- 60–70% of variable compensation reflects enterprise metrics

- Cross-unit collaboration is explicitly rewarded

Implication for the CEO

Boards see misaligned incentives as one of the strongest predictors of execution failure, regardless of strategic clarity.

Red Flag 4: Leadership Capacity Is Underutilized

What boards observe

Leadership diagnostics show that only 50–60% of top-team time is spent on enterprise-level issues in organizations where strategy underperforms.

The rest is absorbed by functional defense and operational firefighting.

What the environment demands

Strategy today requires leaders who can operate beyond their mandates and resolve trade-offs decisively.

What “good” looks like

High-performing teams typically:

- Allocate 65–75% of agenda time to enterprise priorities

- Resolve major disagreements within one to two decision cycles

Implication for the CEO

Boards interpret underutilized leadership as a system and governance issue, not a talent deficit.

Red Flag 5: Data Exists Without Producing Insight

What boards observe

In organizations where strategy underperforms:

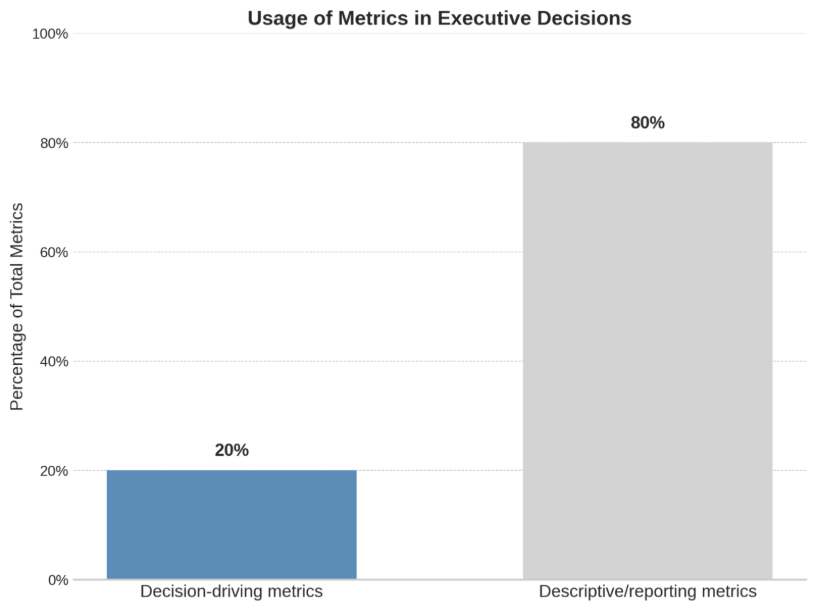

- 80% or more of reported metrics are descriptive, not decision-driving

- Fewer than 20% of dashboards are actively referenced in executive decisions

What the environment demands

Boards expect data to shape strategic trade-offs, not merely validate outcomes.

What “good” looks like

Effective strategy execution relies on:

- 10 – 15 critical metrics, not dozens

- Explicit links between metrics and decision thresholds

Implication for the CEO

Data without insight signals that strategy has not been operationally embedded.

Final Reflection for CEOs

Strategies fail quietly before they fail publicly. The warning signs are structural, measurable, and visible—especially to boards.

When a strategy is working, the organization behaves differently.

When it is not, the evidence is already present.

Author: Mr. Amiya Satpathy is a seasoned transformational leader with over 25 years of experience in driving strategy, digital transformation, and operational excellence across India, Southeast Asia, the Middle East, and Australia. He has held senior leadership roles at Renoir Consulting, Accenture, and PwC, and has led more than 60 high-impact consulting engagements for leading conglomerates, mid-sized enterprises, and start-ups.

His consulting firm, Ved Consulting (https://vedconsulting.co.in), partners with organizations ranging from large enterprises to emerging businesses to support leadership development, strategy execution, and sustainable growth and profitability improvement. For any queries for your Business challenges, you may reach out to him via info@vedconsulting.co.in